Annual federal withholding calculator

Federal Salary Paycheck Calculator. H and R block Skip.

Income Tax Calculator Estimate Your Refund In Seconds For Free

Total annual income Tax.

. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Use these updated tables to calculate federal income tax on employee wages in 2022. 250 and subtract the refund adjust amount from that.

The maximum an employee will pay in 2022 is 911400. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

The tax calculator provides a full step by step breakdown and analysis of each. How Your Paycheck Works. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

Lets call this the refund based adjust amount. Complete a new Form W-4 Employees. But calculating your weekly take.

250 minus 200 50. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your. 15 Employers Tax Guide and Pub.

Change Your Withholding. Then look at your last paychecks tax withholding amount eg. To change your tax withholding use the results from the Withholding Estimator to determine if you should.

Your household income location filing status and number of personal. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Withholding for these types of income differs from standard withholding and the estimator doesnt currently have the ability to provide these sorts of recommendations.

In addition to the annual tax rate and bracket changes employers can still use the. It describes how to figure withholding using the Wage. This publication supplements Pub.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. 51 Agricultural Employers Tax Guide. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any.

The tax calculator provides a full step by step breakdown and analysis of each. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Federal Tax Withholding Calculator OPMgov Main Retirement Calculators Federal Tax Withholding Calculator Retirement Services Calculators The IRS hosts a withholding calculator.

How To Calculate Federal Income Tax

Python Income Tax Calculator Income Tax Python Coding In Python

Pin On Usa Tax Code Blog

Avanti Income Tax Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

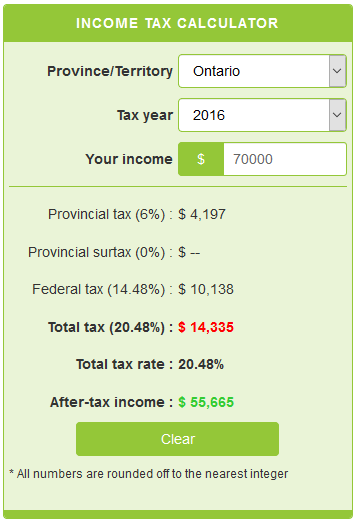

Income Tax Calculator Calculatorscanada Ca

Excel Formula Income Tax Bracket Calculation Exceljet

Ontario Income Tax Calculator Wowa Ca

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Self Employed Tax Calculator Business Tax Self Employment Employment

How To Calculate Income Tax In Excel

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Pin On Finances Investing

Pin On Raj Excel